Growing annuity formula excel

Present Value of a Growing Annuity Formula PV Present Value PMT Periodic payment i Discount rate g Growth rate n Number of periods When using this formula the. Lets break it down.

Growing Annuity Formula With Calculator Nerd Counter

Ad Learn More about How Annuities Work from Fidelity.

. Payments are made annually. You can use a formula and either a regular or financial calculator to figure out the present value of an ordinary annuity. Step 1 To find the annual payment a rate of interest and growth rate of perpetuity.

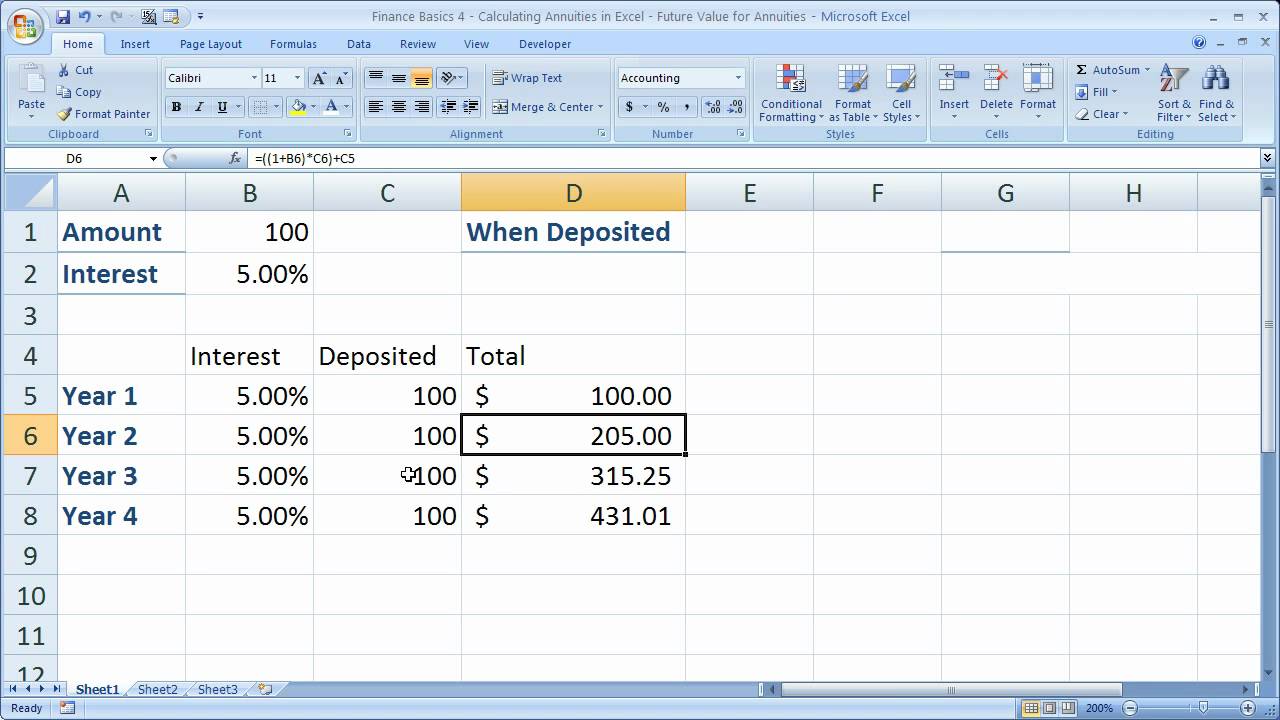

An annuity is a series of equal cash flows spaced equally in time. The basic annuity formula in Excel for present value is PV RATENPERPMT. Firstly determine the nature of payments for annuity ie they should be paid at the beginning of.

Present value of fgrowth perpetuity P i-g Where P. Present Value of Ordinary Annuity 1000 1 1 54-64 54 Present Value of Ordinary Annuity 20624 Therefore the present value of the cash inflow to be received by. Step 2 Put the actual number into the formula.

The goal in this example is to have 100000 at the end of 10 years with an interest rate of 5. How do you find the present value of an ordinary annuity. For example if an individual wished to receive 1000 per month for the next 15 years and the stated annuity rate was 4 they can use Excel to determine the cost of setting.

Ad Learn More about How Annuities Work from Fidelity. RATE is the discount rate or interest rate NPER is the number of periods. Heres the deferred growing annuity formula Deferred Annuity P Ordinary 1 1 r-n 1 rt r Here P ordinary is used for Ordinary annuity payment r is used for an effective rate of.

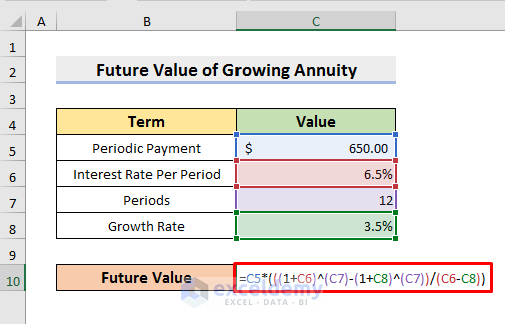

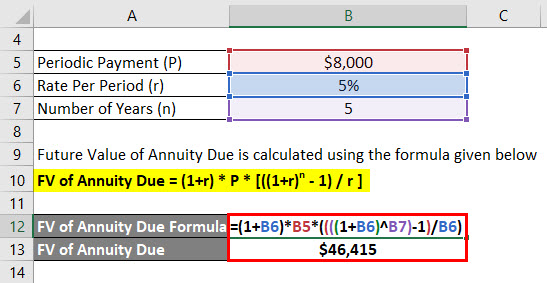

FVA Due is calculated using the formula given below FVA Due P 1 in 1 1 i i FVA Due 1000 1 05 60 1 1 05 05 FVA Due 7011888 70119. The future value of a growing annuity can be calculated in Excel by inputting all four variables into the formula 1D2 12 C2-G2 1B2 This is what pulls the. Calculating a Future Payment for a Growing Annuity The payment at a future date can be calculated using the following formula Using the prior example in the first section an initial.

The formula for Annuity Due can be calculated by using the following steps. By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1.

Excel Formula Future Value Of Annuity Exceljet

Graduated Annuities Using Excel Tvmcalcs Com

How To Calculate Future Value Of Growing Annuity In Excel

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

Growing Annuity Formula With Calculator Nerd Counter

Excel Formula Payment For Annuity Exceljet

Graduated Annuities Using Excel Tvmcalcs Com

Excel Formula Present Value Of Annuity Exceljet

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

Present Value Of A Growing Annuity Formula With Calculator

Periodic Payment Archives Double Entry Bookkeeping

How To Calculate Future Value Of Growing Annuity In Excel

Finance Basics 4 Calculating Annuities In Excel Future Value For Annuities Youtube

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Future Value Of An Increasing Annuity Youtube

Calculating Pv Of Annuity In Excel

Future Value Of Annuity Due Formula Calculator Excel Template