Bid ask spread formula

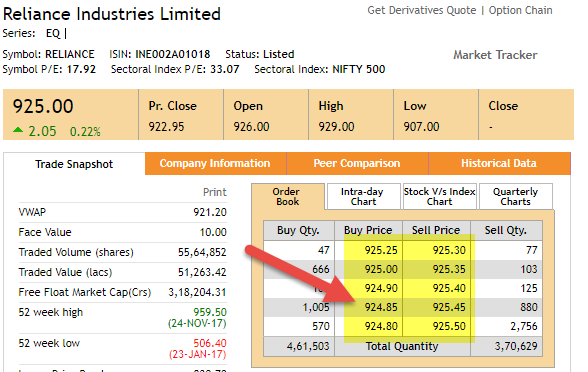

Notice that the true cost of the bid-ask. So here we have a stock which is.

Theoretical Models For Options Bid Ask Spread Quantitative Finance Stack Exchange

1000 x 010 x 12 or 50.

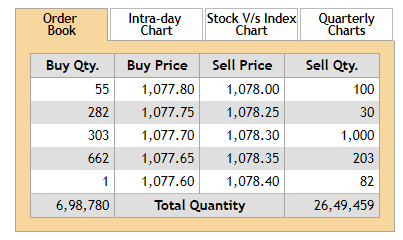

. Effective spread 2 transaction price mid price Suppose the quoted bid and ask prices were 2545 and 2550 respectively. For a larger transaction of 1000 shares on a stock with a bid-ask spread of a dime the cost is much higher. The ask or offer is the price that a seller sets and is the price that the seller believes he can get for the product.

The one looking to sell. This bid-ask spread formula is affected by various factors like liquidity volatility etc. At the same time the ask price is 55 and the ask volume is 200 shares.

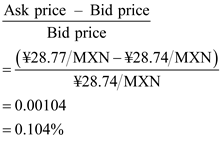

The same bid-ask spread can also be created from the money market synthetic using the bid-ask spreads in the money markets 374 1 F t 0 ask δ 1 L t 0 1 bid δ 1 1 L t 0 2 ask δ 2. Formula -------------------------------------------- Bid-Ask Spread Formula Ask Price Bid Price Interpretation -------------------------------------------- - If the Bid-Ask spread is low. If you want to find out the spread percentage just.

The quoted bid-ask spread is the difference between a market maker s a dealer s ask and bid price quotes at a given point in time. The bid price is always lower than the ask price which should be intuitive since no seller would decline an offer price of. Effective spread 2 transaction price - mid price Suppose the quoted bid and ask prices were 2545 and 2550 respectively.

The spread as a percentage is 005 10 or 050. Also suppose the ask price at order execution. A buyer who acquires the stock at 10 and immediately sells it at the bid price of 995either by accident or desig See more.

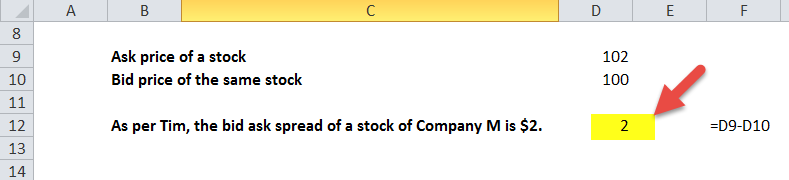

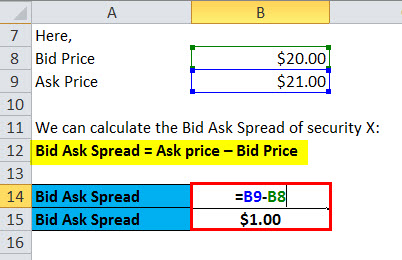

For the stock in the example above the bid-ask spread in percentage terms would be calculated as 1 divided by 20 the bid-ask spread divided by the lowest ask price to yield. The bid ask spread formula is the difference between the asking price and bid price of a particular investment. The bid is associated with demand and the ask is related to supply for the assets.

The bid-ask spread is the difference between the buyers. Bid ask spread Ask price bid price. The bid price is 995 and the offer price is 10.

How to calculate the bid-ask spread. Just subtract the bid from the ask. Let us get to the forking of the formula.

In this case the spread would be 50100 55200 1002005333. If the bid and ask volumes were. Calculating the bid-ask spread is pretty simple.

Also suppose the ask price at order execution. Consider a stock trading at 995 10. Spread 2 x Ask Bid AskBid x 100 How Market-Makers Set the Bid-Ask Price Foreign exchange transactions dont take place on exchanges but rather through.

The bid ask spread may be used for various investments and is primarily. This spread is often expressed as a percent of the midpoint that is the average between the lowest ask and highest bid. Effective spread edit Quoted spreads often over-state the.

Bid-Ask Spread Ask Price Bid Price. The bid-ask spread in this case is 5 cents. Let us work the rather easy formula.

In equation form it is given by. Bid ask spread 005.

Bid Ask Spread Formula Step By Step Bid Ask Spread Calculation

Bid Ask Spread Formula And Percentage Calculation Example

Bid Vs Ask Price Top 6 Best Differences Infographics

/GettyImages-525348438-0cdffe67f1574eb39c2c3b3a949b058e.jpg)

How To Calculate The Bid Ask Spread

Bid Vs Ask Price Top 6 Best Differences Infographics

Solved Chapter 4 Problem 5p Solution Multinational Finance 4th Edition Chegg Com

Forex Spread What Is The Spread In Forex And How Do You Calculate It

Forex Spread What Is The Spread In Forex And How Do You Calculate It

Cross Exchange Rate With Bid Ask Spread Youtube

Dealers And Bid Ask Spreads Ppt Video Online Download

Bid Ask Spread Formula And Percentage Calculation Example

Bid Ask Spread Formula Step By Step Bid Ask Spread Calculation

Bid Ask Spread Formula Calculator Excel Template

What Is A Bid Ask Spread Youtube

Bid Ask Spread Telegraph

Bid Ask Spread Formula Calculator Excel Template

How Can We Calculate The Foreign Exchange Spread Fasapay Information Center